The Roadmap for Tomorrow’s Bank

Together we are shaping the future of banking. Find out more about Contovista’s success stories here.

Together we are shaping the future of banking. Find out more about Contovista’s success stories here.

Contact usWhat we can achieve together

Our claim: By working closely with our customers, we drive innovation and generate value for banks while providing the best finance management experience in an efficient and cooperative manner.

Radicant: The first digital sustainability bank in Switzerland

Radicant implements the Carbon Footprint Manager, which calculates the individual CO₂ footprint based on transactions. In this way, it supports customers in achieving their individual sustainability goals.

Valiant: Central financial cockpit

Together with Valiant Bank, we introduced Switzerland’s first fully comprehensive multibanking solution in September 2019. Since then, Valiant Bank’s business clients have been able to aggregate all third-party bank accounts via a central financial cockpit and manage liquidity via single bank access.

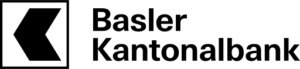

VZ VermögensZentrum: Sucessfull integration of PFM and Carbon Footprint Manager

The integrated financial assistant in the VZ Financial Portal offers comprehensive features: Easily define savings goals, identify tax-deductible transactions, and thanks to the spending overview widget with categorized expenses, keep a better eye on your finances. Another highlight: The transaction-based calculation of the CO₂ footprint, which compares your personal CO₂ consumption to the Swiss average

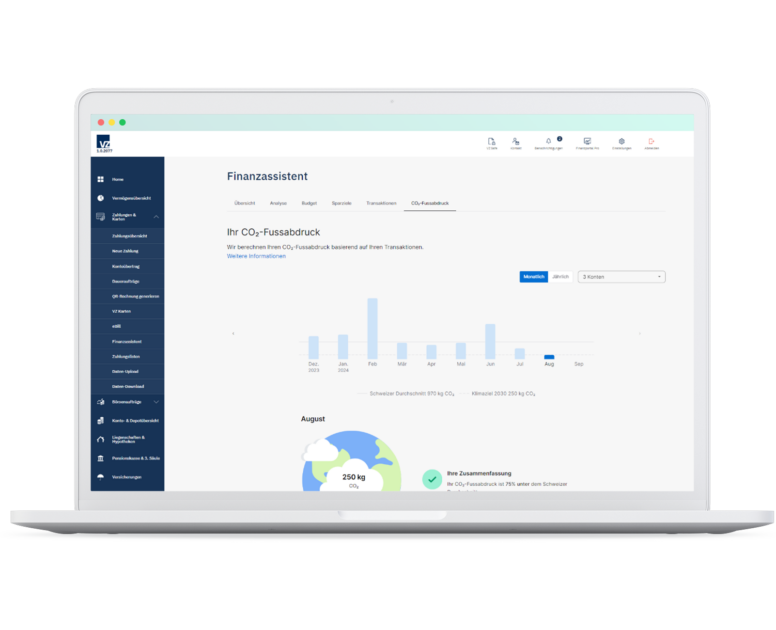

Raiffeisen Österreich: Better customer experience with the PFM

As the largest bank in Austria with over 3 million customers, Raiffeisen launched our PFM back in 2016 to offer a brand new digital customer experience. All transactions are clearly displayed, offering users a 360° view of their finances. In addition, savings targets can be set and budgets determined.

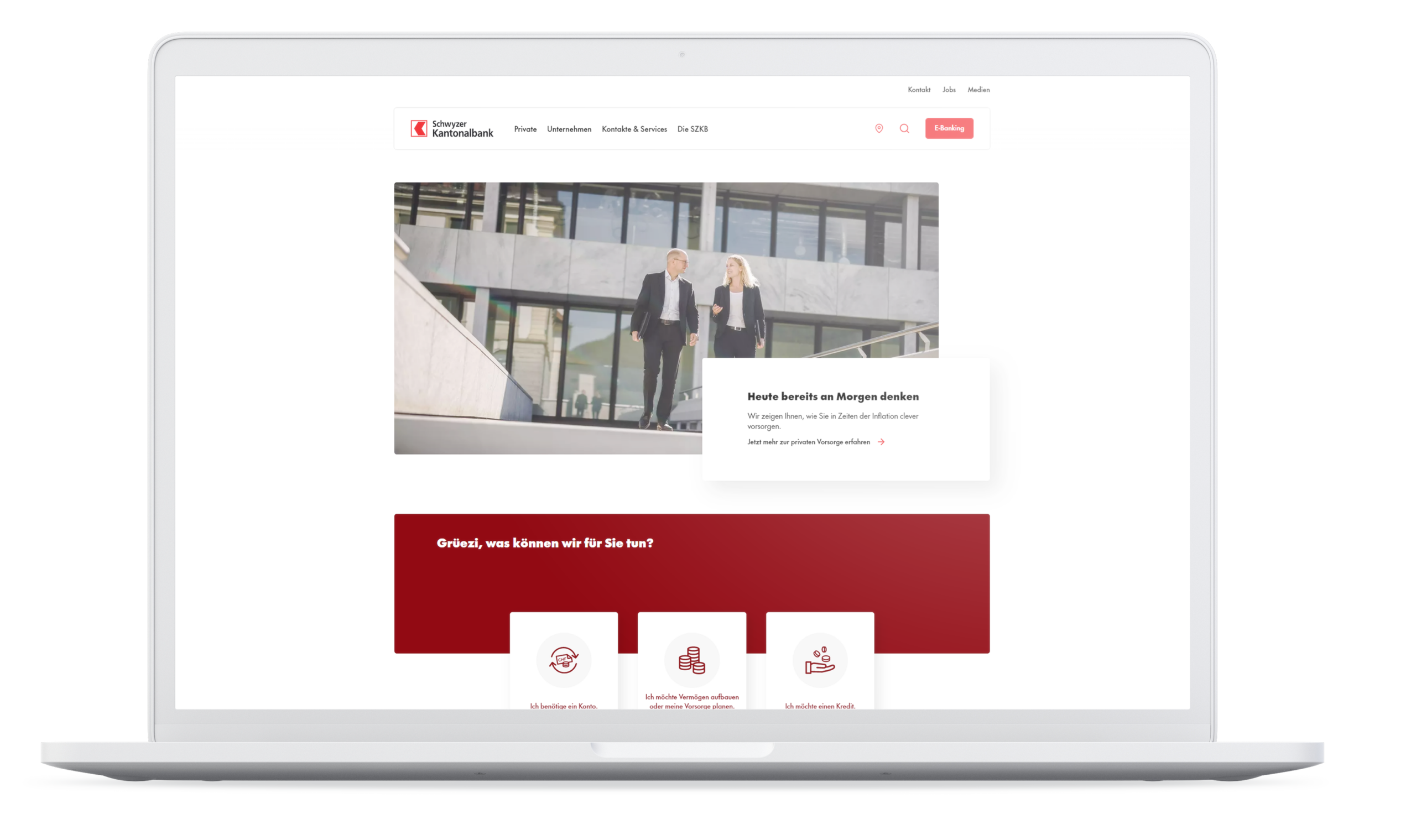

Schwyzer Kantonalbank: Complex analytics project pays off

Schwyzer Kantonalbank leverages our analytics models specifically for sales, consulting and marketing. Using sophisticated machine learning methods and a 98% categorisation rate, we identify product-related target groups with the highest probability of closing. This made it possible to increase the closing rate for a personal loan campaign by 69% compared to the bank’s conventional sales methods.

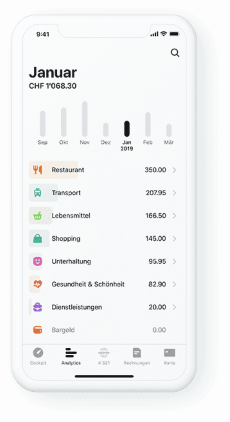

neon: Fast onboarding of the API

Switzerland’s first independent account app uses our API interface to clearly show its users all cash flows, divided up into categories. Through flexible and professional implementation of the requirements, we managed to successfully implement this project within two months.

Viseca: Successful app integration

Viseca has integrated our PFM into the one app to link real-time card transaction information with automated categorisation. This way, app users have a full overview of their spending – anytime, anywhere. With more than 1 million users, the one app is among the most used financial apps in Switzerland.

We work with strong partners

It is not only thanks to our team of experts that we have transformed from a FinTech start-up into a market leader. The high degree of innovation, the quick, seamless integration into different core banking systems as well as our long-standing partners in the Swiss ecosystem have also made a significant contribution to this. For all this, we thank you!

We are happy to be there for you!

If you have any further questions or are interested in our success stories. We will be happy to tell you more about us in a personal conversation.

Contact us